Who needs a W-2 Form?

Form W-2 is an obligatory form to be completed by every employer. Form W-2 doesn’t have to be filled out by the employee. It is given to inform the employee about the amount of his annual income and taxes withheld from it.

What is the W-2 Form for?

Form W-2 contains the exact amount of money paid to the employee and the amount of taxes paid on his earnings for the year. While the W-2 Form is filled out by an employer only, it is sent out to other people to inform them about the income and tax withheld. There are three parties that receive the form:

-

Government

-

State

-

Employee

Even though an employee does not fill out the form, he might need it when filling out the 1040.

Is W-2 accompanied by other forms?

If form W-2 is filled out by the employer, it isn't followed by any other forms. But when an employee gets W-2 form for guidance, he attaches a tax return to the W-2 copy.

When is the W-2 form due?

The W-2 form is due January 31, otherwise the employer risks breaking the law and being penalized for that.

How do I fill out form W-2?

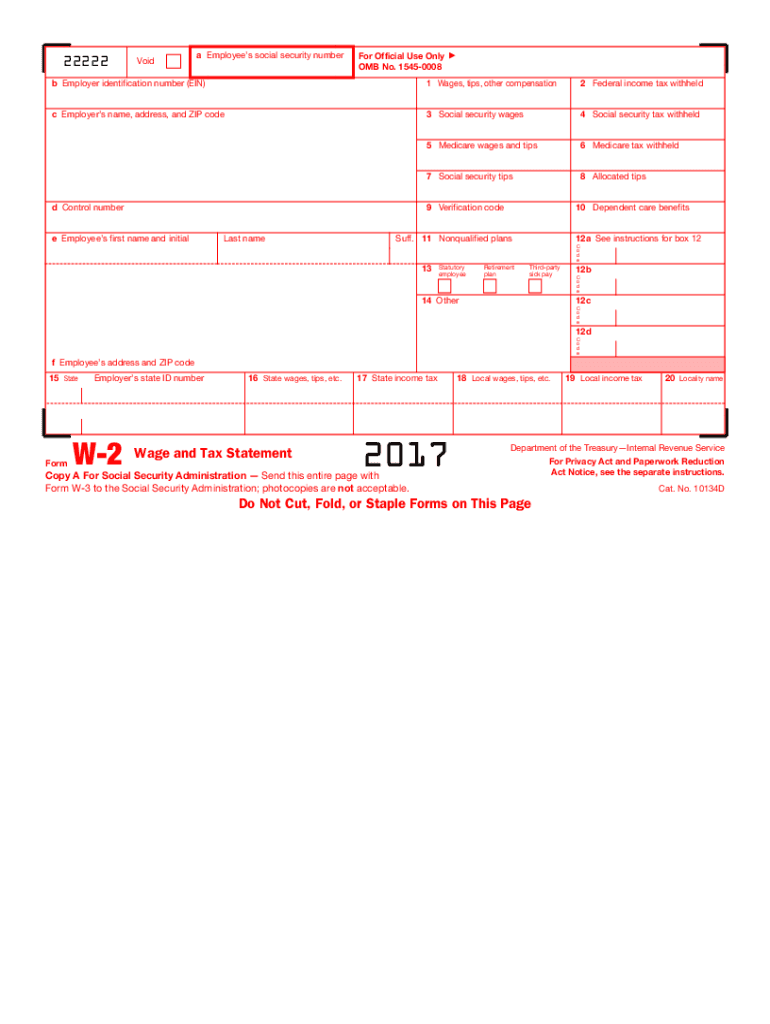

In general, the W-2 form is divided into two parts each with numerous fields to be completed carefully by an employer. The section on the left contains both the employer's and employee`s names and contact information as well social security number and identification number.

The part on the right concerns actual wages and taxes paid on it. The fields are as follows:

-

Annual wages and compensation

-

Income tax withheld by the federal authorities

-

Taxable social security wages

-

Social security taxes paid on the wages

-

Annual medicare wages

-

Medicare tax withheld from the annual pay

-

Social security tips

-

Allocated tips

-

Field 9 should not be filled out since it will be removed from the form W-2

-

Dependent care benefits paid by the employers on employee`s behalf

-

Nonqualified plans deferred compensation

-

Different types of compensation and benefits (with a letter code)

-

Your employer's state ID number

-

Total amount of state wages

-

The amount of tax withheld from state wages

-

Field Local wages

-

The amount of local tax withheld locally

-

Locality name is the legal name of the city or state

Where do I send the W-2 form?

As has been mentioned above, the W-2 form is submitted by the employer to the Internal Revenue Service, employee and state government.